🕒 Estimated reading time: 2 minutes

In 2025, earning six figures in the US no longer guarantees financial comfort.

High inflation, student loans, housing costs, and lifestyle inflation are pushing even high-salaried professionals into financial stress.

Here’s how white-collar workers can break the cycle and finally feel some relief — without quitting their careers.

Making six figures used to mean financial comfort. In 2025, it’s barely enough.

From tech workers in San Francisco to consultants in New York, many high-income earners are discovering the truth: income alone doesn’t guarantee freedom anymore.

💸 The Six-Figure Illusion

It sounds impressive: $120,000 a year. But after taxes, health insurance, rent, student loans, and retirement contributions, most professionals are left wondering, “Where did it all go?”

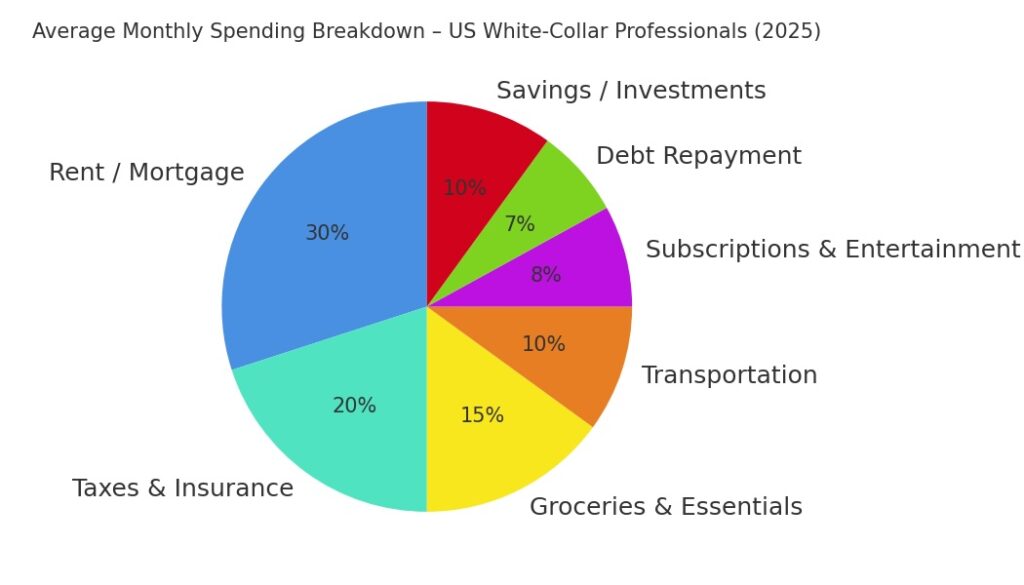

The math doesn’t lie:

- Federal & state taxes: ~30%

- Rent or mortgage: $2,000–$3,500

- Transportation, insurance, food, debt: another 30–40%

- And what’s left? Often, not enough to build wealth.

🧠 The Real Problem: Lifestyle Creep

High earners tend to spend more as they earn more — bigger apartments, better tech, more dinners out, luxury subscriptions.

Result? Their financial stress doesn’t disappear, it just wears nicer clothes.

“I make more than I ever have — and yet I’m more anxious about money than ever.”

— Jason M., 34, Software Engineer, Chicago

🔄 How to Take Control (Without Changing Jobs)

You don’t need a new career — you need a new system.

Here’s how white-collar workers are regaining control in 2025:

✅ 1. Track Every Dollar — Without Judgment

Use a modern budget planner that shows you where your money actually goes, without feeling guilty.

✅ 2. Challenge Your Spending Habits

Try a 30-day no-spend challenge. It’s not about deprivation — it’s about awareness.

Small daily savings can add up to $500 or more.

✅ 3. Automate Savings, Not Just Bills

Set a weekly or biweekly auto-transfer to a high-yield savings account.

Even $100 a week = $5,200 a year.

✅ 4. Build a Micro-Income Stream

Passive income isn’t just for influencers. Try a weekend freelance gig, a digital product, or affiliate blogging.

Use a Passive Income Selector Tool to see what suits your lifestyle.

🔚 Closing Thought

Your income is a tool — not a solution.

If you’re feeling financially stuck despite earning well, you’re not alone — but you can reset.

Spend smart. Save with intention. Earn with purpose.

Because six figures should feel like six figures.