🕒 Estimated reading time: 2 minutes

In 2025, a quiet revolution is taking place in personal finance — and it’s being led by your smartphone.

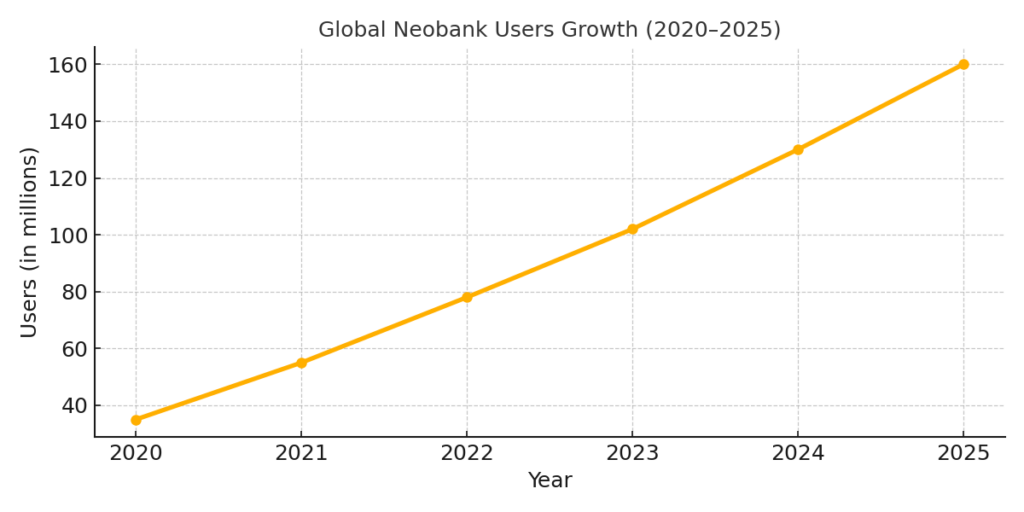

With rising dissatisfaction around hidden fees, slow processing, and lack of transparency, millions of users across the US and Europe are leaving traditional banks behind and switching to no-fee digital banks, also known as neobanks.

💳 Why Now?

- Interest rates are still low, but fees keep rising

- Younger users demand instant access and clean UX

- AI-powered budgeting tools are now integrated into accounts

- Regulation has opened the door for non-bank financial players

🔍 Who’s Leading the Charge?

Here are a few fintechs reshaping the way we bank:

- Revolut — Known for its fee-free currency exchange, crypto access, and global cards

- Chime — One of the fastest-growing US neobanks, built around no overdraft fees

- N26 — A European powerhouse offering sleek mobile banking with transparent pricing

- Monzo — UK-based, with AI budgeting tools and instant payments

🧠 Why You Should Pay Attention

Neobanks aren’t just cheaper. They’re smarter.

With built-in features like:

- Real-time notifications

- AI-driven savings rules

- Instant international transfers

- Weekly expense breakdowns

…neobanks offer value that most traditional banks can’t match — unless they dramatically evolve.

📉 The Losers: Brick-and-Mortar Giants?

While legacy banks still dominate loan markets and business finance, they’re quickly losing everyday consumers to fintechs that are faster, cheaper, and more intuitive.

In response, some are partnering with or acquiring fintech startups — but the shift is already underway.

✅ What Should You Do?

Ask yourself:

- Are you paying monthly fees for your bank account?

- Can you automate your savings?

- Do you see where your money goes in real time?

If not — it might be time to explore neobanks.