🕒 Estimated reading time: < 1 minute

As of mid-2025, a new wave of tariff threats between the United States and China is putting global investors and consumers on high alert. The dispute, which reignited over disputes in semiconductor supply chains and clean energy tech, could lead to billions in retaliatory tariffs and disrupted markets.

🔍 What’s Happening?

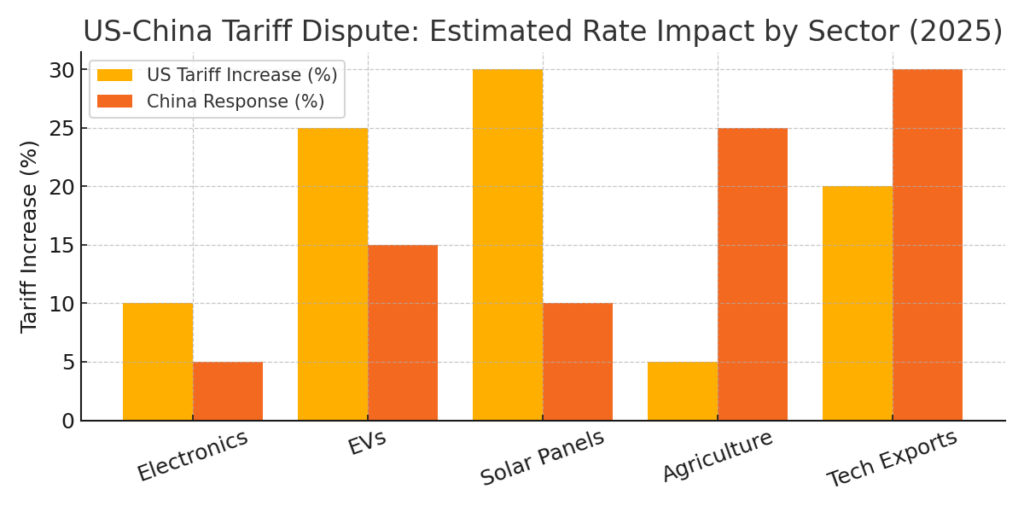

- The US is considering new tariffs on Chinese electric vehicles (EVs) and solar panels.

- China has responded by warning of countermeasures on US tech exports and agricultural goods.

- Analysts expect ripple effects across electronics, raw materials, and freight costs.

🧠 Why This Matters to Everyday People

Tariffs aren’t just headlines — they affect prices, trade, and even side hustle costs.

- 📦 Electronics may become more expensive

- 🚢 Shipping rates for imported goods could rise

- 🌾 Food exports may face delays or pricing shifts

- 💰 Stock markets react quickly — especially tech and industrials

📉 Small Investors Should Watch Closely

“Geopolitical instability is the #1 wildcard for 2025’s investment markets,”

— Financial analyst at MarketPulse.

Those investing in international ETFs, Chinese tech, or US manufacturers should monitor policy shifts closely.

✅ What You Can Do Now

- Consider diversifying your investment portfolio across non-affected regions

- Keep an eye on freight costs and product sourcing if you’re in eCommerce

- Avoid short-term panic selling — wait for policy clarity