🕒 Estimated reading time: 2 minutes

As of this morning, the Dow Jones Industrial Average surged by over 250 points, signaling renewed investor optimism following the release of a stronger-than-expected U.S. jobs report and growing speculation that the Federal Reserve may pause interest rate hikes in the coming quarter.

📊 Dow Jones Today: Key Highlights (April 2025)

- +1.2% intraday gain, led by financials and tech

- Top gainers: JPMorgan Chase, Apple, and Boeing

- Volatility drops, VIX below 14 for the first time in months

- Bond yields eased slightly, giving markets additional breathing room

🔍 What’s Driving the Market Today?

- Jobs Report Surprises to the Upside

The Labor Department reported an increase of 320,000 jobs in March, beating analyst expectations and indicating a resilient labor market. - Fed Officials Hint at Pause

Several Federal Reserve members have signaled a likely hold on rates, citing stable inflation and slowing credit activity. This news fueled buying in rate-sensitive stocks. - Strong Q1 Earnings

Early reports from key Dow components like Procter & Gamble and UnitedHealth exceeded estimates, adding momentum to the index.

🧠 What This Means for Investors

- Short-term: Market sentiment is bullish, but analysts caution about profit-taking near resistance levels.

- Medium-term: A Fed pause could open the door to more aggressive equity allocations in diversified portfolios.

💬 “The Dow rally today reflects real optimism about a soft landing — but don’t ignore macro risks,” says analyst Laura Stein of EastPoint Capital.

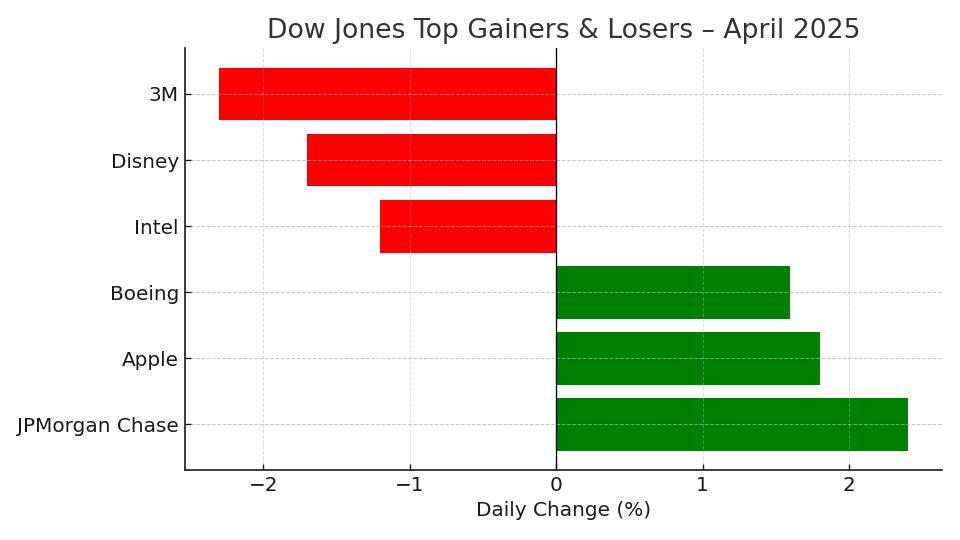

📊 Top Gainers and Losers – Dow Jones Today (April 2025)

🔼 Biggest Gainers:

- JPMorgan Chase (+2.4%) surged on strong earnings in the banking sector.

- Apple (+1.8%) rallied after unveiling new AI-powered devices.

- Boeing (+1.6%) climbed as aircraft orders increased globally.

🔽 Biggest Losers:

- Intel (-1.2%) slipped due to semiconductor supply concerns.

- Disney (-1.7%) dropped as streaming growth showed signs of slowing.

- 3M (-2.3%) fell sharply following a disappointing quarterly report.

💬 This daily movement reflects shifting investor sentiment as tech rebounds while industrials remain sensitive to earnings pressure.