🕒 Estimated reading time: < 1 minute

As inflation and everyday expenses continue to challenge American households, cashback credit cards have become a smart way to offset spending. In 2025, several U.S. banks are stepping up their game by offering some of the highest cashback rates ever seen, particularly on categories like groceries, gas, travel, and streaming.

💳 Best Cashback Banks in the U.S. Right Now

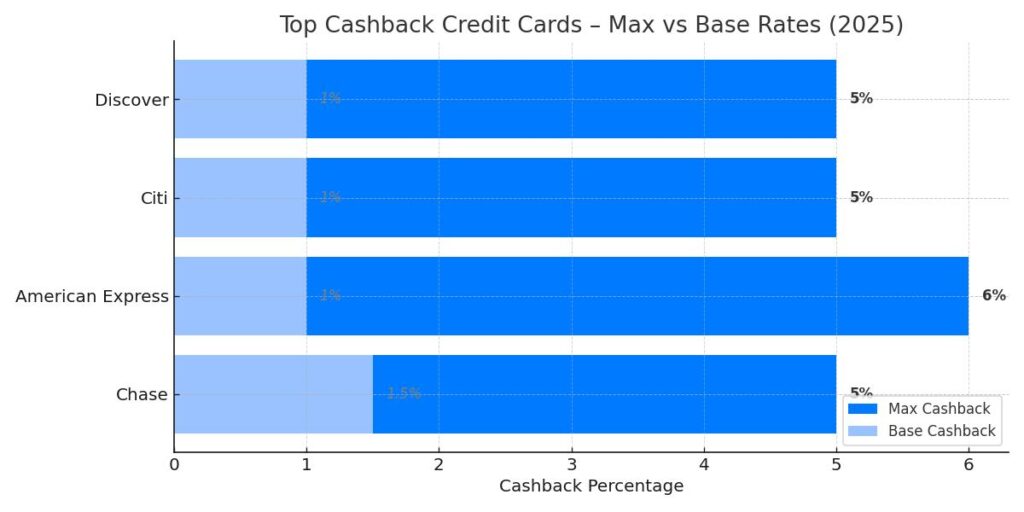

1. Chase Bank – Freedom Unlimited®

- Up to 5% cashback on travel booked through Chase

- 3% on dining and drugstores

- 1.5% base rate on everything else

2. American Express – Blue Cash Preferred®

- 6% cashback at U.S. supermarkets (up to $6,000/year)

- 3% on transit and gas

- Ideal for families and everyday spenders

3. Citi – Custom Cash℠ Card

- 5% cashback on your top spending category (up to $500/month)

- Automatically adjusts based on your usage

4. Discover – It® Cashback

- 5% rotating categories (groceries, Amazon, gas, etc.)

- 1% on all other purchases

- Cashback match in the first year = double the rewards

🧠 Why Cashback Cards Are Trending in 2025

- Rising living costs are pushing consumers to seek rewards on essentials

- Younger demographics are favoring spend-based rewards over travel perks

- Fintech integration allows for real-time cashback tracking and smarter budgeting

💡 Pro Tip

Use a budgeting tool or spending tracker app to maximize cashback by category. Some users report earning $1,200+ annually just by optimizing card usage!