🕒 Estimated reading time: 2 minutes

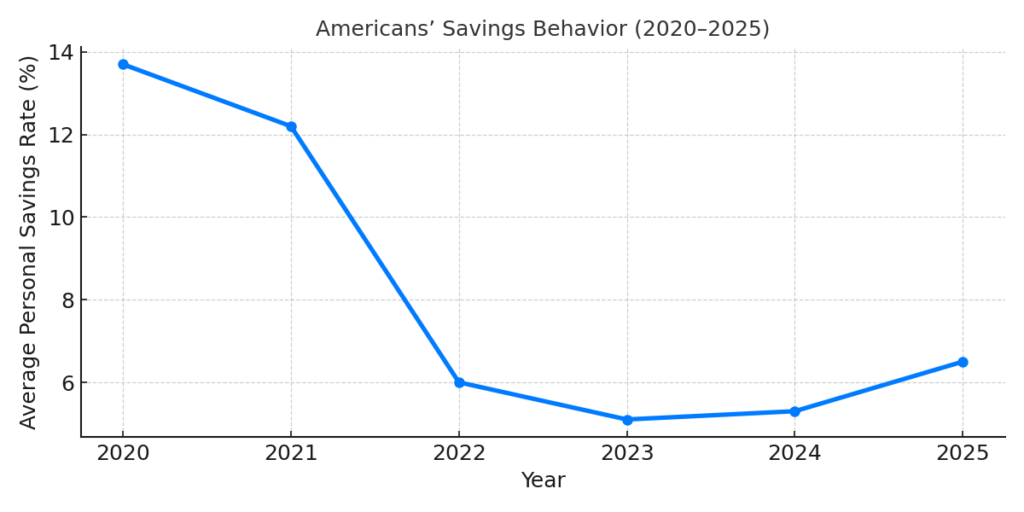

With inflation still lingering, rent prices sky-high, and interest rates adjusting slowly, 2025 has become the year where smart saving and investing aren’t optional — they’re survival.

💡 What’s Different in 2025?

- 🏠 Housing Costs Remain High: Even as inflation slows, rent and mortgage rates stay elevated.

- 💳 Debt Is Growing: Credit card balances hit all-time highs in Q1 2025.

- 📉 Real Wages Are Flat: Salary growth has not kept pace with the cost of living.

- 💼 Job Security Is Shifting: The gig economy continues to rise, but with fewer benefits.

In short, Americans are realizing that saving alone isn’t enough — they need to invest strategically to build long-term financial security.

💸 Where Are Smart Americans Putting Their Money?

- High-Yield Savings Accounts

- With interest rates above 4%, it’s now rewarding to save again.

- Robo-Investing Apps

- Platforms like Wealthfront, Betterment, and Fidelity Go help automate and diversify portfolios.

- Series I Bonds & Treasury Bills

- A safe haven for those worried about market volatility.

- Index Funds Over Individual Stocks

- More stable, less stressful, and better long-term returns.

🧠 Financial Wellness = Mental Wellness

According to a recent survey by SmartMoney Insights:

“67% of Americans say financial stress directly affects their mental health.”

Which explains why more people are treating their savings plan like a self-care routine.

✅ Takeaway for 2025:

- Automate your savings

- Invest with intention, not emotion

- Build a buffer before you build risk

- Use tools that simplify decisions

💬 “You don’t need thousands to start building wealth — just the right mindset and a consistent plan.”

In 2025, saving and investing smartly isn’t a luxury — it’s how Americans are staying ahead of inflation, debt, and uncertainty. Start now, even small moves matter.