🕒 Estimated reading time: 2 minutes

In an era of fintech apps, AI-driven underwriting, and alternative credit scoring tools, one thing remains constant in the world of personal finance: Your FICO score still holds the key to your financial future.

Whether you’re applying for a mortgage, getting approved for a business loan, or opening a new credit card, banks and lenders continue to rely heavily on your FICO score to determine how much of a risk — or reward — you are.

🏦 Why Banks Still Care About FICO Scores

Despite the rise of open banking and alternative data models, traditional financial institutions in the US still use FICO scores as a primary credit evaluation tool.

- 🔎 First impression: Lenders often check your score before anything else

- 📉 Lower score = higher interest rates or rejections

- 💳 Influences everything from loan terms to credit card limits

- 🛑 Some fintech platforms still require a minimum FICO to onboard users

“Your FICO score isn’t just a number — it’s a trust signal in the financial system,”

says James Nolan, a credit strategist at FinRank.

📊 FICO Score Breakdown (2025 Standards):

| Factor | Weight |

|---|---|

| Payment History | 35% |

| Credit Utilization | 30% |

| Length of Credit History | 15% |

| New Credit | 10% |

| Credit Mix | 10% |

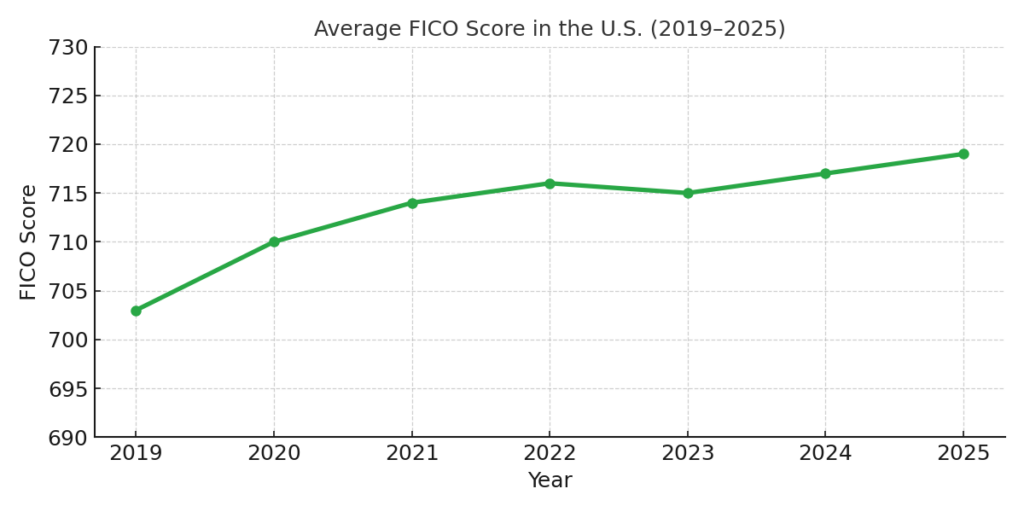

💡 Why It Matters More in 2025

- Inflation and rising interest rates mean good credit saves you thousands

- Buy Now, Pay Later platforms like Klarna and Affirm are now reporting to bureaus

- A high FICO opens doors to business loans, home ownership, and lower fees

✅ What You Can Do Today

- Check your FICO score via apps like Experian, Credit Karma, or your bank

- Pay bills on time — always

- Keep credit card utilization below 30%

- Avoid unnecessary hard inquiries

- Diversify your credit (not just credit cards)